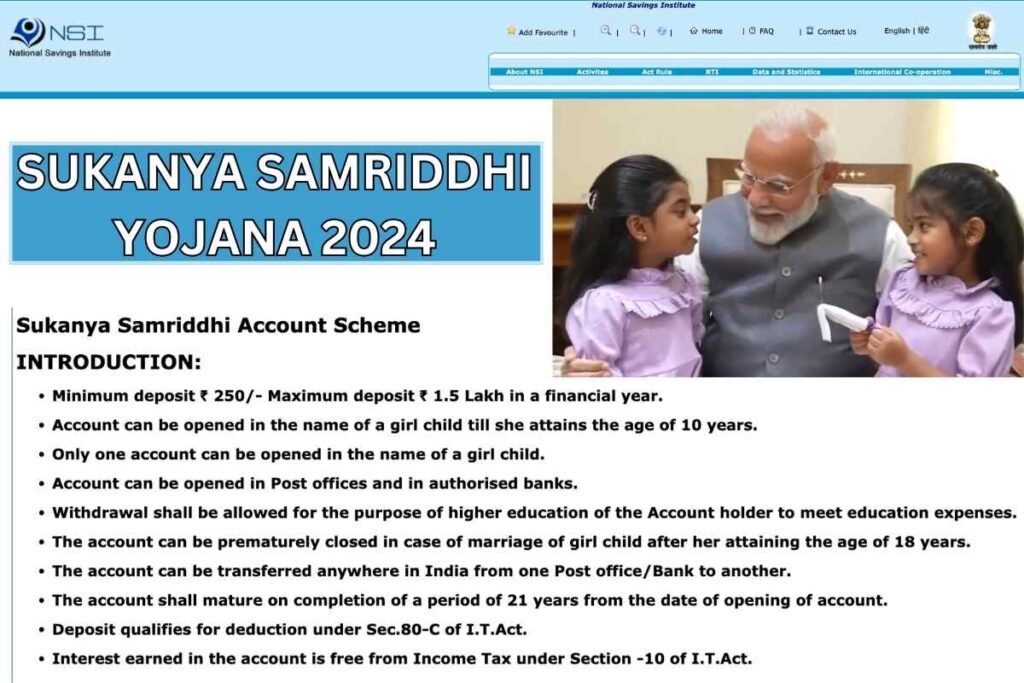

Sukanya Samriddhi Yojana 2024 is a backed savings by government scheme focussed at attaching the financial future of girl children in India. Started on January 22, 2015, as bit of the “Beti Bachao, Beti Padhao” campaign, this scheme encourages parents to free their daughters’ education and expenses for marriage. With attractive interest rates and tax benefits, SSY is a popular choice for parents seeking a reliable investment for their daughters’ futures. Check The Sukanya Samriddhi Yojana Eligibility 2024, Sukanya Samriddhi Yojana Objectives 2024 below in the post.

Sukanya Samriddhi Yojana 2024

Sukanya Samriddhi Yojana 2024 stands out as a significant initiative by the Indian government to promote the financial empowerment of girl children. By providing a high-interest savings scheme with tax benefits and flexible withdrawal options, SSY ensures that parents can secure the future of their daughters with ease and reliability. With its broad accessibility through numerous banks and post offices across the country, the scheme is well-positioned to continue benefiting millions of families in the years to come.

Sukanya Samriddhi Yojana 2024

| Scheme name | Sukanya Samriddhi Yojana 2024 |

| Initiated by | Government of India |

| year | 2024 |

| Launched date | January 22, 2015 |

| Age | 10 |

| Amount | 1.5 Lakh |

| Beneficiary | Girl Child |

| Category | Yojana |

Sukanya Samriddhi Yojana Objectives 2024

The basic objective of Sukanya Samriddhi Yojana is to encourage the well-being of girl children by providing parents a structured saving mechanism. It aims to ensure that families have the necessary funds to support their daughters’ higher education and marriage, reducing financial barriers to their empowerment and success.

Sukanya Samriddhi Scheme Eligibility 2024

To get shortlisted for the SSY scheme:

- Girl Child Age Limit – The A/c can be opened for a girl child who is not greater than the age of 10 at the time of opening of the account.

- Number of Accounts – Only 1 A/c per girl child is permitted, with a maximum of two accounts per family. Exceptions are made for twins or triplets in the same birth order.

- Residency – The girl child must be a resident Indian at the time of account opening and remain so throughout the tenure of the account.

Benefits for Sukanya Samriddhi Yojana 2024

- The minimum annual deposit is ₹250, while highest is ₹1,50,000 per year.

- The interest rate is measured by the government and is tentative to make revisions quarterly. As of the upcoming news, the interest rate is 8.0% p.a.

- Donations to the SSY account are qualified for tax deduction of Income Tax Act under Section 80C. Both the main amount and the interest which is earned are tax-exempt.

- The account reaches maturity when the candidate turns 21 years from the opening date or when her age is 18 years and her marriage is done with the girl child. Half withdrawals of up to 50% are allowed for higher education once the girl child attains 18 years.

- SSY A/cs can be shifted anywhere in India, ensuring continuity even if the family relocates.

How To Apply Online Sukanya Samriddhi Yojana 2024

Offline Method

- Go to any bank or post office.

- Fill out the SSY A/c opening form.

- Submit the necessary documents which include the birth certificate of the girl child – ID proof – address proof of the parent or guardian.

Online Method

Some banks offer online account opening through their websites. This typically consists of inserting data in an online form and uploading scanned copies of the required documents.

Requisite Documents for Sukanya Samriddhi Yojana 2024

- Birth Certificate – Proof of age of the girl child.

- KYC Documents – ID and residency proof of the parent or guardian.

- Photographs – Passport-size pictures of the girl child and the guardian.

- Application Form – Duly inserted data and signed application form which is obtained at banks and post offices.

How to Calculate Sukanya Samriddhi Yojana (SSY) 2024

To measure the full-fledged amount for SSY 2024, you can follow these steps:

- Know the Current Interest Rate – As of 2024, the interest rate for SSY is 8.0% per annum, compounded annually.

- Annual Contributions – Determine the amount that the candidate plans to contribute annually. The lowest annual contribution is INR 250, and the highest is ₹1,50,000.

- Investment Period – The SSY A/c full fledged after 21 years from the starting date. However, contributions are made for the first 15 years, and the amount continues to earn interest for the next 6 years.

- Use the Formula for Compound Interest – The full fledged amount can be calculated by applying compound interest formula:

A = P (1 + r/n) ^ nt

Where:

A = Maturity amount

P = Annual contribution

r = Annual interest rate (8% or 0.08)

n = Number of times interest is compounded per year (1 for annually)

t = Number of years the money is invested or compounded (21 years for maturity calculation)

- Consider Annual Compounding – Since the interest is compounded annually, \( n \) will be 1.

Advantages of Using a Calculator for Sukanya Samriddhi Yojana (SSY)

- Accuracy – Calculators make sure that small computations, lessen the risk of manual errors in complex calculations involving compound interest.

- Time-Saving – Automated calculators directly compute results, saving time as relative to human calculations.

- Ease of Use – well designed interfaces make it simple for anyone to work, in spite of their mathematical proficiency.

- Instant Results – Calculators provide immediate results, helping users make quick financial decisions.

- Scenario Analysis – Users can input different variables (e.g., contribution amounts, interest rates) to see how changes affect the maturity amount.

- Planning and Forecasting – Calculators help in financial planning by forecasting the future value of investments based on current contributions and interest rates.

- Accessibility – Online calculators are widely available and can be obtainable from anywhere with an wifi connection.

- Visual Representation – Many calculators offer graphical representations of growth over time, making it easier to understand investment progress.

- Customizable – Users can tailor inputs to their specific financial situations, providing personalized projections.

- Educational Tool – Using calculators helps individuals learn about compound interest and the impact of various financial decisions on long-term savings.

Sukanya Samriddhi Yojana 2024 FAQs

Calculators ensure precise computations, minimizing manual errors in complex calculations.

The minimum annual deposit is ₹250, and the maximum is ₹1,50,000 per financial year.